Use this simple change to save money on every AirBnB bookings

Airbnb is one of the most successful examples of companies following the sharing economy business models. Users can rent their own homes out or stay in other people's places where it is legal to do so.

If you have never used Airbnb, you can use my referral link here to gain between £30 free credit, or local currency equivalent, for your next stay.

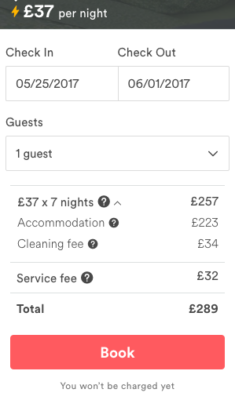

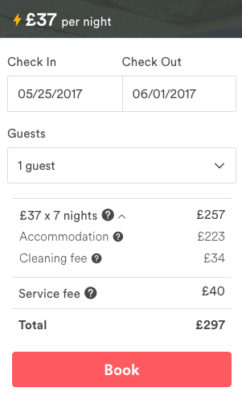

One thing I stumbled across was how their ‘service fee' was different between mine and my friend's accounts when we were researching a place together. Compare the following two images below for a search in London.

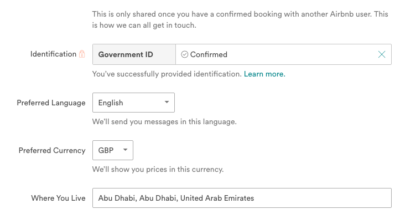

The right hand picture is when I said my hometown was London, which calculated the service fee to be £40. The left hand side was when I put Abu Dhabi as my home.

You can change the address in your profile at any time, as many times as you need.

Airbnb Claims that the change in service fee is due to VAT, as indicated in their help section:

Airbnb charges VAT on its service fees for customers from Albania, Iceland, Norway, Russia, Seriba [sic], South Africa, Switzerland, Taiwan, The Bahamas, and The European Union. In Japan, JCT applies to the hosts and the guests. In New Zealand, GST applies to the hosts and the guests.

However, I am rather skeptical about the whole idea of it being purely down to VAT. In the 30-ish times I have used Airbnb, not once have I received a compliant VAT receipt (it would need to show the ex-VAT price plus the total VAT paid). Also, in the example above, the VAT rate in the UK is 20%, so the service fee should be 1.20 * £32 = £38.4. With rounding to an integer it could either be £38 or £39 but should not £40.

While an address difference will not make huge savings on each stay, a few pounds here and there will surely add up if you are a frequent user.

Better be careful doing that. People have been permanently bounced from Airbnb for having false or what Airbnb thinks is false information.

Your math is incorrect. Assuming the 40 is vat inclusive then the vat being charged is (40*.2), thus netting 32 without vat.

Regardless good point about avoiding the vat.

My VAT calculation is correct – £32 is the net price and it is 20% of that, meaning total VAT in this case is £6.4. Going from their dodgy inclusive price would be £40/1.2 = £33.33. You can also play around with http://www.vatcalculator.co.uk/ which confirms my calculation.

Yes, I have used https://www.howmuchisthevat.co.uk to calculate the VAT and £33.33 is the correct number.

Unfortunately this website is not working. I wrote on JS a simple VAT calculator here https://vatulator.com/

This website was stolen( The new one is here https://vatulator.co.uk/

Interesting observation – I agree with Rufus’ comments around would this be seen as bad practice by Airbnb. It’s a loophole and unless it says in T&Cs then fair game.

T&c says it!

Check the VAT at http://www.vatcalculator.info/.

much much easier to use https://www.howmuchisthevat.co.uk to calculate vat online.

ONLINE VAT CALCULATOR

Including or Excluding VAT to a price in a single click with our online VAT calculator.

HOW TO USE ONLINE VAT CALCULATOR?

Three simple steps you can follow to calculate VAT for including or excluding VAT off the price.

Check the VAT rate (20%, 5%, and 0%).

Enter an amount.

Enter an amount in ” Including VAT” to calculate the sum with VAT or ” Excluding VAT” to deduct the VAT from an amount.